By Jack Reed and Gary Cohn

In 2009 a change in government forced Greece to admit the truth about its troubled economy: Greece had joined the European Union under false pretenses. It’s economic condition was artificially made to look better than it was due to help from the American investment house Goldman Sachs. Goldman Sachs had helped Greece to hide hundreds of millions of dollars in debt, and in the process netted itself a “premium fee” of $300 million. “The deal also made up 12 percent of Goldman’s $6.35 billion in trading and investment revenue for 2001,” writes Garry Levine for Al Jazeera.

In 2005 Goldman Sachs intervened in a Greek economic crisis a second time, restructuring the original bad deal by increasing debt, stretching out payments, and increasing Goldman’s cut to “something like $500 million.”

Gina Raimondo

Gina Raimondo

Now in 2009 the new government in Greece was facing yet another crisis, and a team from Goldman Sachs, lead by Gary Cohn, now Chief Operation Officer for Goldman Sachs, flew in to offer yet another restructuring.

“Cohn offered to finance the country’s health care system debt, pushing it far into the future,” writes Levine, “After all, argued Goldman’s team, it had worked before.”

Levine goes on to write, “The Wall Street house not only earned large transaction fees and rights to future Greek revenue, it also hedged its investments, essentially placing a bet on the economy of Greece to fail. Looking at the deals in the rearview mirror, analysts said Goldman’s exposure on Greece was, for all intents and purposes, zero.”

Greece turned down Cohn’s offer, and was forced to accept decades of grueling austerity to work its way out from under mountains of debt. A Greek generation or two will be lost, even as political fascism predictably rises in response to economic privation. Preventable political disaster looms, because Goldman Sachs wanted more money.

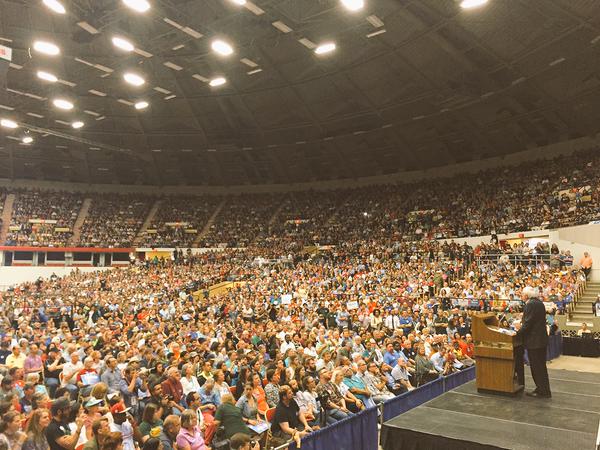

Now, in an East Side bike shop with Governor Gina Raimondo, Senator Jack Reed, Mayors Elorza, Diossa, Grebien, Badelli-Hunt and more press than I’ve seen gathered in weeks, Gary Cohn was offering the state $10 million in small business training and funding, and everyone seemed to think this was a great idea.

I couldn’t have been the only person who thought there was irony in Cohn’s statement that, “We at Goldman Sachs… like to be accountable for what we do.”

Goldman Sachs is giving away free money, perhaps to salve their consciences or to buy some positive press after nearly destroying the world economy, or perhaps to inspire a new generation of rich suckers to fleece in the next market bubble. It doesn’t really matter why they are doing it.

When Rhode Island takes the money, they should know that the money comes, in part, at the expense of the Greek people, who suffer because a vampire-like Wall St. bank has consigned the country to half a century of brutal, soul-destroying austerity.

As Levine says so eloquently in his Al Jazeera piece, “The consequences are born by ordinary Greek people that now find themselves in the the economic equivalent of debtors’ prison.”

We should understand the moral consequences of accepting money stained with the blood, sweat and tears of a nation’s future.

Matt Bodziony, President of NBX Bikes

Matt Bodziony, President of NBX Bikes

Reed and Cohn

Reed and Cohn

Elorza, Reed and Cohn

Elorza, Reed and Cohn