Protracted crisis looms with Southern debt, slowing growth

By Sep 25, 2018

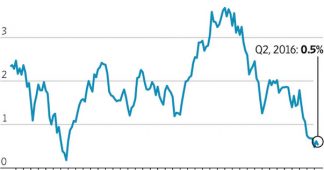

Ten years since financial markets crashed in the United States (U.S.), the world economy is anything but near so-called “recovery.” Far from it: global economic growth is still slower since the crisis. Investment, which includes flows of capital for new production and for buying up other companies, declined for 2017.1 Global unemployment is estimated at 192 million for 2018.2 “Global value chains”, production networks controlled by transnational corporations (TNCs) which benefit from lower labour costs, are said to be slowly declining.3 Economies in the global South are threatened with the possibility of debt crises that could unravel in the next years.

If anything, the 2008 financial crash exposed to the public the faults in the neoliberal policy that had been promoted for at least four decades by U.S.-dominated international finance institutions such as the International Monetary Fund and the World Bank Group (IMF-WB).

With liberalised and de-regulated finance, the market for various and complex “financial products” grew in the last decades—resulting unstable bubbles of speculation had burst in the early 2000s and again in 2008. With Southern economies opened up to varying degrees by neoliberal policy, TNC-led “value chains” emerged to maximize cheaper labour, production costs and inputs.

Read more at https://mronline.org/2018/09/25/a-decade-since-the-2008-crash/