By

The financial meltdown of 2008 prompted calls for a global financial system that curtails trade imbalances, moderates speculative capital flows, and prevents systemic contagion. That, of course, was the goal of the original Bretton Woods system.

But such a system today would be both untenable and undesirable. So, what might an alternative look like?

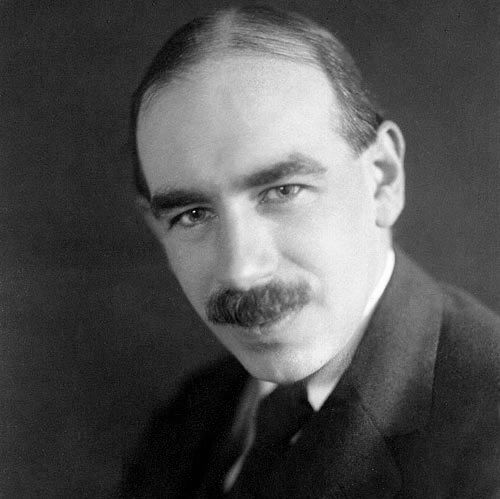

The 1944 Bretton Woods conference featured a clash of two men and their visions: Harry Dexter White, President Franklin Roosevelt’s representative, and John Maynard Keynes, representing a fading British Empire.

Unsurprisingly, White’s scheme, founded on the United States’ post-war trade surplus, which it deployed to dollarize Europe and Japan in exchange for their acquiescence to full monetary-policy discretion for the US, prevailed. And the new post-war system provided the foundation for capitalism’s finest hour – until America lost its surplus and White’s arrangement collapsed.

Read the full article here:

https://www.socialeurope.eu/2016/05/imagining-new-bretton-woods/