IMF

Greek default: To be or not to be?

Dimitrios Konstantakopoulos

The following is from an interview transcript

The situation in Greece is a little bit complicated. You should remember that Greece is not any...

EU (Germany), IMF(America) agree on destroying Greece

We remind our readers that Greece, a member of the Eurozone and the EU and the birthplace of the notions of Democracy and Europe, has...

Mama Mia. After the Germans, now Americans want to save Greece!

Ted Malloch the prospective US Ambassador to the EU has nothing else to do now than appearing to one TV station after another in Greece, suggesting to...

Greek debt crisis: an existentialist drama with no good end in...

By Larry Elliott

Original post date: 5 February 2017

Put three people in a room who can’t get on with each other. Condemn them to stay...

Why we shouldn’t now leave the Euro!

By Dimitris Konstantakopoulo

“Where the peril grows, grows also what will save us”

Friedrich Hölderlin

“The Greek race was always, and it is still, the race which has the dangerous...

Grèce : « allègement » en trompe-l’œil

Par Michel Husson *

En août 2015, quelques semaines après le non au référendum, le gouvernement grec signe le troisième accord (MOU, Memorandum of Understanding)...

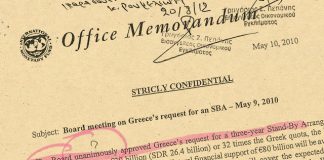

IMF – The secret documents, or how they destroyed Greeks and...

The CADTM draws attention to two IMF documents dating from March and May 2010 that were kept secret. These authentic documents were placed at the disposal...

They keep lying while they argue about how to proceed with...

IMF is arguing for restructuring the Greek debt, which it recognizes as "highly non sustainable".

It contributed largely itself to this result by organizing "Bail...

Ιceland, Banks and Pirates

celand recently held new elections following the resignation of its Prime Minister due to the Panama Papers. In an interview with the activist Árni Daníel Júlíussson, the Lexit Network gathered updated information on the current situation in Iceland. We spoke also about the crisis, crisis policies, social movements in Iceland, the Euro and the question of EU-Membership.

The danger of Germany’s current account surpluses

Through the prism of the trade balance, the current account surplus can be viewed as a symptom of Germany’s economic success. German exports increased from 30% of GDP in 2000 to 47% in 2015. But with imports at merely 39% of GDP, this implies that Germany is providing capital to the rest of the world at a very high rate. Indeed, German savings have